The Wasatch Building Pulse Q2 2025

Residential building permits

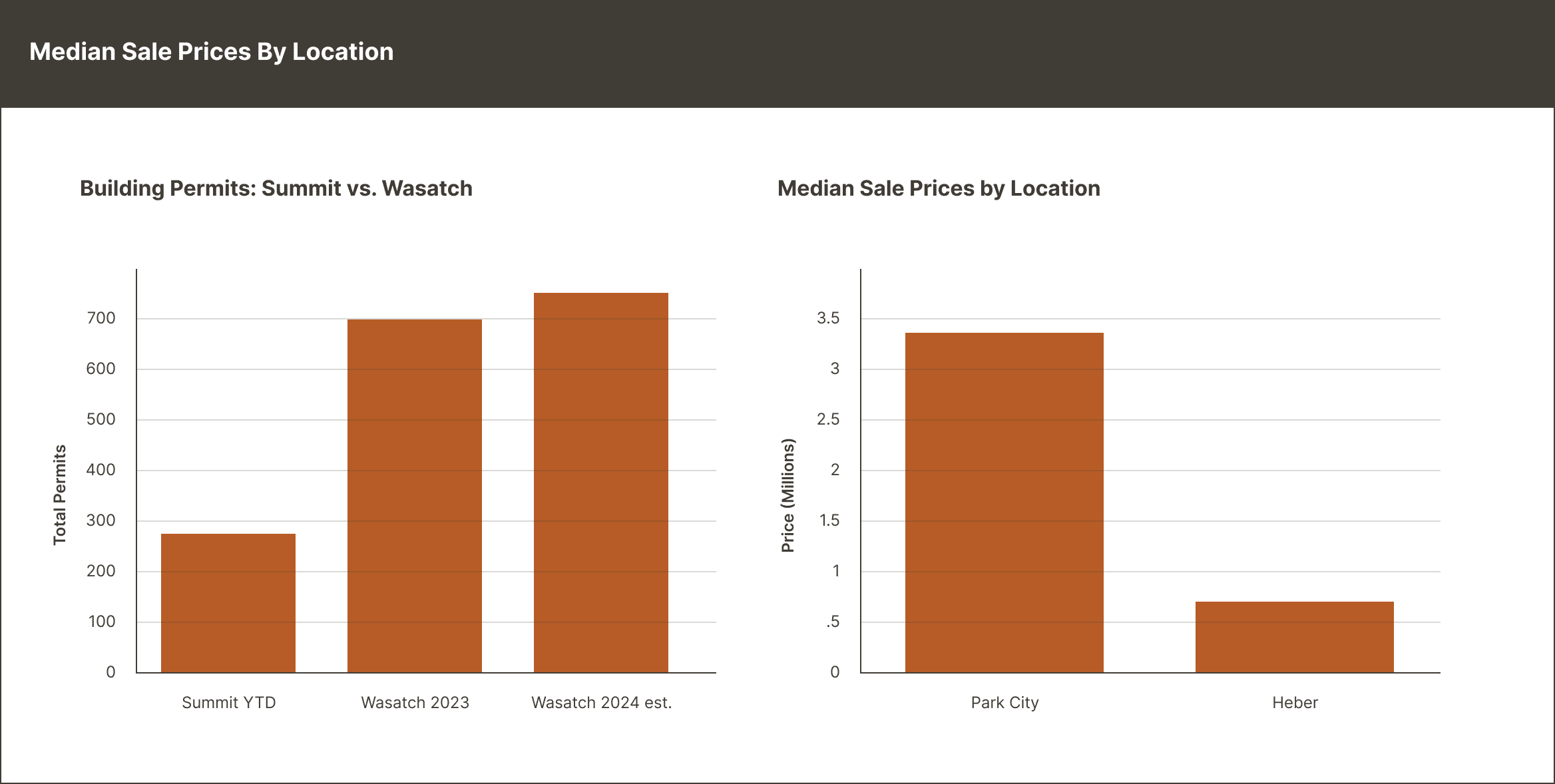

Summit Co. YTD (Jan 1–Apr 17):

290 total permits

74 new single-family homes

▲ 4%

Wasatch Co. 2023

700 permits → 2024 pace tracking slightly higher

▲ 6%*

New-construction listings on the market

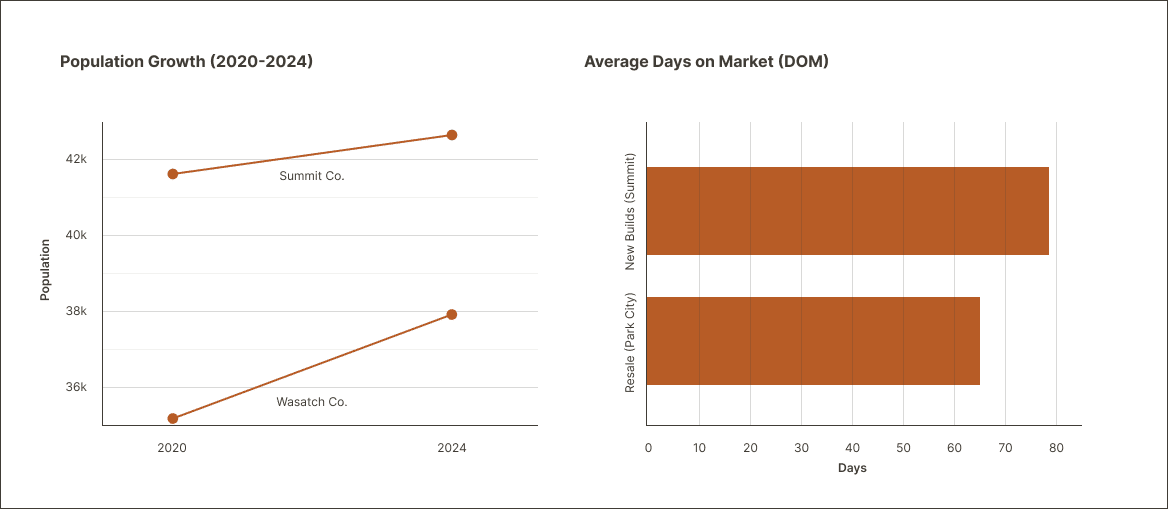

Summit Co.: 116 active new-build listings; median list price $1.6 M; average time to offer 78 days

▲ inventory, ▼ DOM

All resale listings

average DOM

Park City zip 84098: 66 days

▲ 20 days

Vacant lots for sale

Summit Co.: 350 land parcels on MLS; median list $1.6 M

▲ 12%

Median sale price (all property types)

Park City: $3.40 M

Heber: $704 K

▲ strong luxury segment

Typical new-build price window

$900 K – $7 M (90% of listings), outliers to $20 M+

Summit Co. +1.8% → 43,109

Wasatch Co. +8.8% → 37,858

Utah – 7.00% (Bankrate, 25 Jun 2025)

Roughly 3M recreation visitors each year; tourism drives $2.2 B in local spending

Prospective Builders – Five Things

To Watch

1

Deer Valley East Village Expansion

Phase Two earth-work and a two-stage gondola are underway; seven more lifts are scheduled to open by winter 2025-26, adding 2,000+ ski-in/ski-out units over the next five years.

2

The festival will relocate after the 2026 event, removing an estimated $132M in annual economic impact and 24 K out-of-state visitors; officials are scrambling for replacement events.

3

2025 legislature requires most Wasatch-Front cities to allow detached ADUs, easing density rules on parking and lot size. Though Summit/Wasatch are exempt today, the bill suggests statewide momentum toward higher-yield lots.

4

Park City Planning Commission green-lights a 1,971-stall underground garage and transit hub, clearing the path for Deer Valley’s long-stalled base-village build-out.

5

Utah 30-yr rates dropped below 7% for the first time since November, spurring a 9% month-over-month jump in mortgage applications, according to local lenders’ weekly reports.

Life After Sundance: Will a $132 Million Hole Cool the Construction Boom?

When Sundance leaves Park City in 2027, the town stands to lose more than red-carpet celebrities. The festival’s 2024 economic study pegged its contribution at $132M GDP, 1,730 jobs and $14M in tax revenue. Roughly a third of the 73,000 attendees rent short-term lodging at premium winter rates.

Short-Term Shock

Luxury-rental owners face a 10-day vacancy that once fetched $1,500-$3,000 per night. For spec builders targeting nightly-rental investors, that missing revenue stream trims projected IRRs by 1-2 percentage points. Lenders already report tighter underwriting for projects whose pro formas leaned on festival pricing.

Why the Sky Isn’t Falling

The ski season now stretches Thanksgiving to May; Deer Valley’s mega-expansion and Vail’s Epic Pass partnership support record skier visits even without Sundance traffic.

Remote-work buyers still prize the Wasatch Back’s 30-minute commute to SLC International. Net-migration into Summit and Wasatch counties continues to outpace statewide averages.

Utah’s tourism office is courting a “Mountain Futures” tech summit to fill the January slot, promising 15 K high-spend visitors if funding is secured. (RFP pending, Summit County Council minutes, 6 Jun 2025).

Takeaways for Builders

- Diversify product: pivot some inventory from nightly rental condos to primary residence townhomes that meet ADU-ready guidelines in HB88.

- Watch hotel keys: East Village plans eight destination hotels; an oversupply of high-end rooms could soften STR rates further after 2026.

- Leverage shoulder-season perks: market net-zero or high-performance homes that cut holding costs for owners no longer banking on 10-day cash surges.

About the Data

- Oak-n-Crete compiles this dashboard each quarter using:

- County building-department permit logs (Summit & Wasatch)

- Redfin MLS analytics for inventory, pricing & days-on-market

- U.S. Census QuickFacts & CO-EST tables for population trends

- Bankrate for Utah mortgage-rate averages

- Park Record & Salt Lake Tribune for local economic news

Do you have a metric you’d like to track next quarter?

Let us know at build@oakncrete.com