The Wasatch Building Pulse Q3 2025

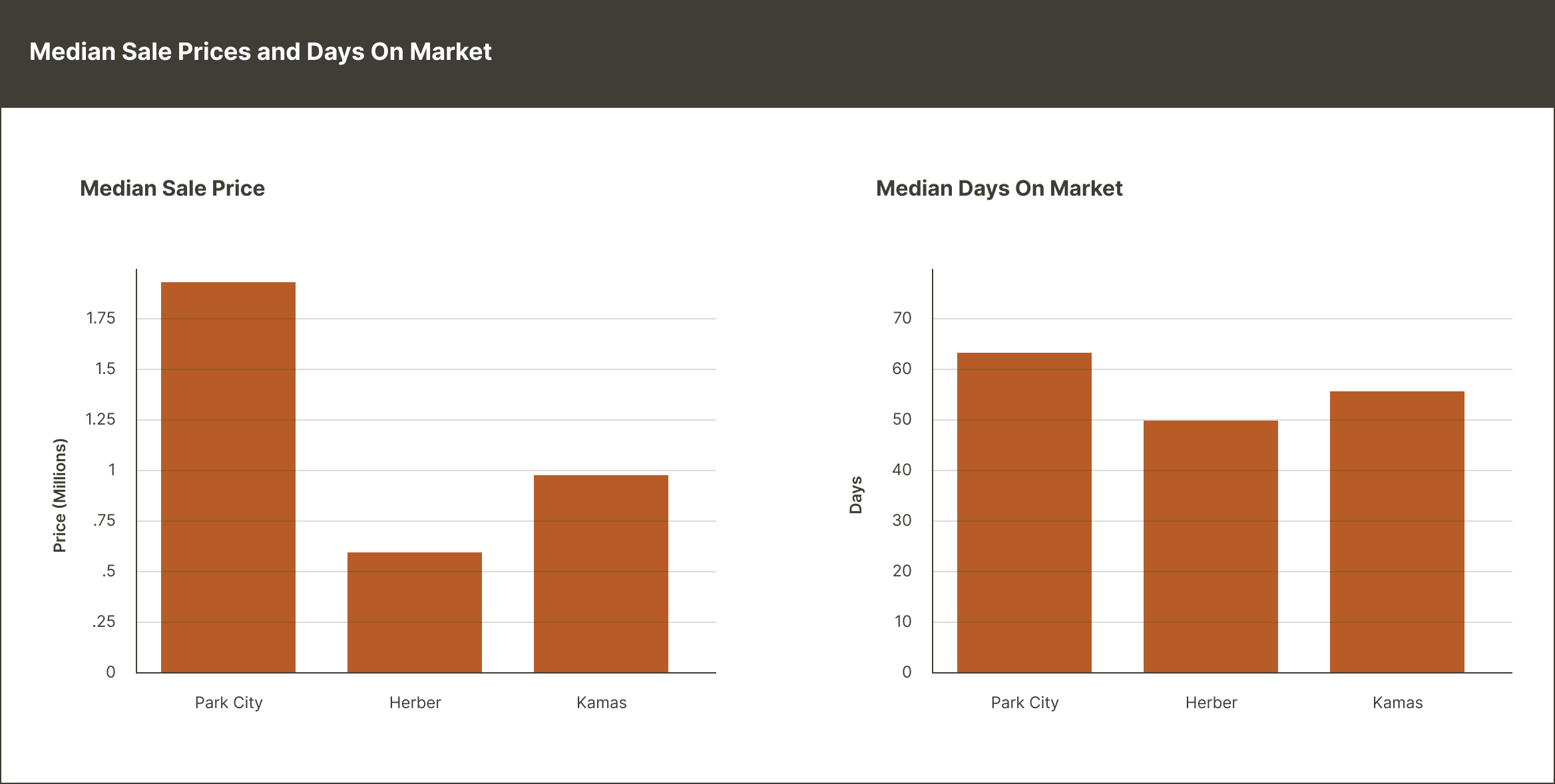

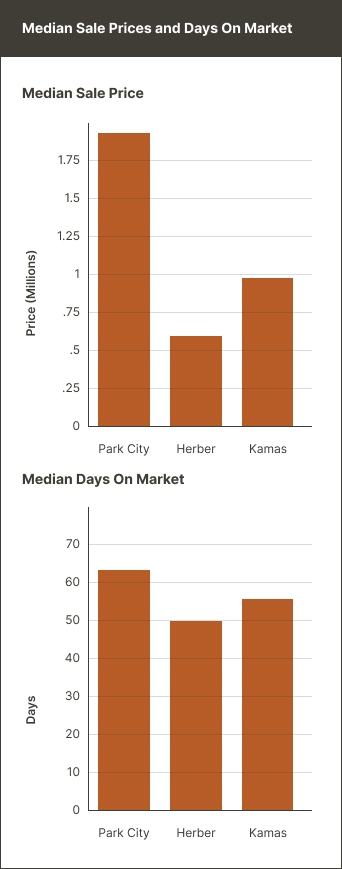

Park City

(84060 & 84098)

Summary

- Pricing power is modest but improving at the margin.

- More homes are cutting prices to find the market.

- Buyers have the leverage aside from “hot” listings.

Heber

84032

- Heber’s pricing reset continues, but deals are still clearing near asking with longer marketing periods.

Kamas

84036

Summary

- This is a smaller, higher‑variance sample, so take it with a grain of salt.

- Mix shifts (more upper‑end closings) pushed medians up even as $/sf dipped.

Utah Still on the Rise

SLC International passenger traffic in 2024 set a record, and YTD 2025 remains elevated. Capacity and route growth continue to support second‑home and tourism demand for our beautiful state.

Build‑cost pulse

Materials: Producer Price Indexes for construction inputs show low‑single‑digit YoY increases mid‑summer, a mild re‑acceleration from spring.

Labor & backlog: Utah unemployment holds in the low‑3s; construction employment growth has cooled from 2023 but remains positive, which is keeping skilled‑trade markets tight.

Our Take: Expect around 2–4% input inflation run‑rate through end of year, barring a commodity shock

Five Things to Watch for Builders

1

Heber Valley Corridor (U.S.‑40 bypass) decision window.

Two build alternatives for the new bypass remain under review. The eventual decision will reshape traffic, visibility and land‑use on the valley floor. Builder lens: bank site plans near future interchanges, consider noise & access buffers.

2

New state‑level WUI standards and insurer scrutiny are pushing owners to harden homes, and some carriers to re‑price or non‑renew. Builder lens: spec and custom designs should emphasize ignition‑resistant exteriors, 0–5 ft non‑combustible zones, and defensible space to protect insurability and resale value.

3

Summit County is weighing tighter enforcement and new state tools to identify unlicensed STRs. Builder lens: underwrite nightly‑rental pro formas conservatively; confirm HOA/municipal allowances early.

4

Venue upgrades and a long run‑up in hospitality planning will pulse through Park City/Deer Valley over the next 24-36 months. Builder lens: anticipate infrastructure work windows, workforce competition, and premium demand in venue‑adjacent submarkets.

5

After a quiet first half, construction PPIs ticked higher in July (metals, transport). Builder lens: lock key packages early (steel, roofing, appliances); reconsider escalation clauses on long‑duration builds.

Local Happenings

- Wildfire/insurance town halls (Hideout & Wasatch Back) spotlight mitigation and premium pressure; more communities adopting Firewise best practices.

- Olympics “listening tour” reached Wasatch Back venues; community input underway on transport, crowding, and neighborhood readiness.

- Visitation: Park City Chamber reports a strong start to 2025; airlines maintain robust capacity into SLC.

- Heber mobility: Corridor study outreach continues; property owners begin positioning for potential access changes.

- Deer Valley/East Village: Site and infrastructure works continue in phases as entitlement and resort plans advance.

The Heber Valley Bypass:

What Will It Mean for Builders?

U.S.‑40 through Heber is the spine for the Wasatch Back’s fastest‑growing corridor. UDOT’s Heber Valley Corridor project is evaluating two bypass alternatives to ease choke points through town while preserving Main Street’s character.

A selection would catalyze new nodes of activity at interchanges and alter travel times between U.S.‑40, Midway, and Jordanelle.

Near‑term Impact on Land Values

Parcels with future frontage/access near the chosen alignment typically re‑rate; parcels on the “old” corridor may gain pedestrian appeal but lose drive‑by traffic. – Use mix: Expect interest in convenience retail, fuel, service, and light‑commercial pads at future interchanges—useful anchors for mixed‑use or townhome clusters. – Noise/offsets: Proximity premiums trade off with noise. Design with berms, building orientation, and landscape buffers; spec higher STC assemblies for bedrooms facing the corridor.

Tips for Builders

- “Intercept” product near interchanges: compact townhomes/stacked flats over small‑format retail; shared structured parking to buffer traffic.

- “Quiet‑side” move‑ups one or two blocks off the alignment: larger lots with WUI‑ready landscaping; market the quiet + fast access combo.

- Trail‑first infill along Old Town/Main Street: smaller footprints, front‑porch typologies, and pocket plazas to capitalize on calmer traffic and footfall.

Permitting & Phasing Tips – Lock in access agreements early; coordinate with UDOT staging so utility work isn’t re‑dug. – Bake in 5–10% schedule float for seasonal windows (frost/snow) and material lead‑times. – Firewise details (Class‑A roofs, ember‑resistant vents, non‑combustible first 5 ft) improve insurability and buyer confidence.

Bottom line: A bypass selection will redraw the convenience map of Heber Valley. The best‑positioned projects will marry quick access with quiet streets and wildfire‑smart design.

About the Data

This edition draws from MLS analytics (Redfin market trackers), state labor and price indices, transportation data and local reporting.

Do you have a metric you’d like to track next quarter?

Let us know at build@oakncrete.com